Nick Innes-Jones

Welcome to the sixth BDO Construction Sector Report, our annual study of New Zealand’s construction industry. Based on a nationwide survey of more than 210 business owners and leaders in March-April 2024, the report reveals that while the industry appears to be recovering from the construction-specific challenges so prevalent in recent years, it’s now encountering wider economic pressures.

Along with an overview of the challenges facing the construction sector right now, our report captures the current sentiment of construction business leaders and explores their expectations for the future. We deep-dive into specific projects, business types and regional issues, while also sharing practical tips for construction business leaders to help navigate the challenges ahead.

Watch below as BDO Construction Sector Leader Nick Innes-Jones shares his views on the BDO Construction Sector Report and provides tips for construction leaders.

VIEW OUR REPORT SECTIONS This report has been developed for device-friendly viewing in a web-based format (no PDF attachment). Please click on the icons below to view our report insights in each section; overall insights, subsector trends, regional commentary & tips for construction leaders |

The construction industry has evolved since our last report in 2023, when a post-COVID building boom saw many construction companies struggling with more work than they could manage. Some of the sector-specific issues that have plagued construction businesses in recent years - including supply chain disruptions and labour shortages – have now stabilised, making way for wider macroeconomic forces to make their mark.

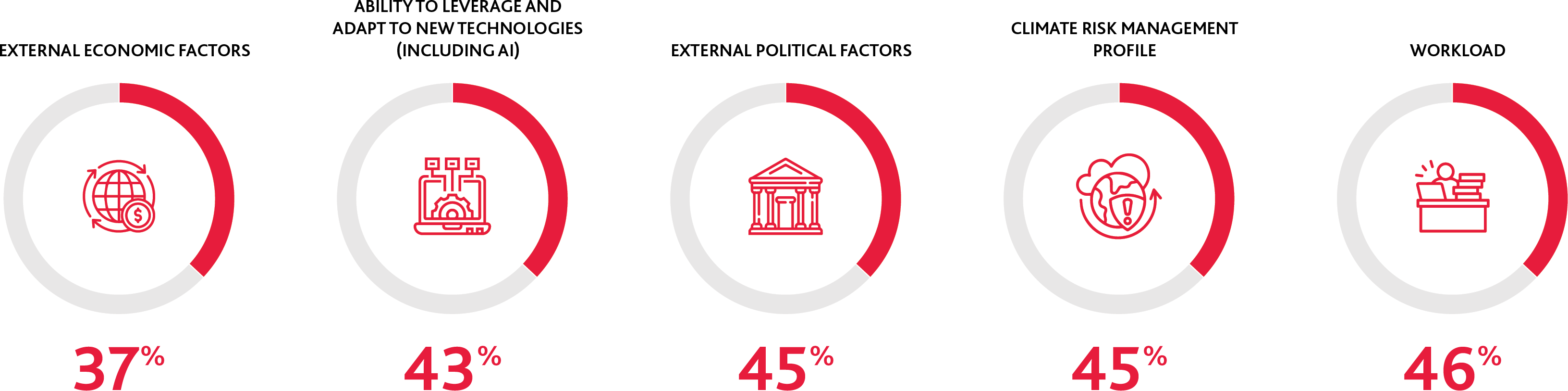

As New Zealand’s economy hovers around recessionary levels and remains connected to international market dynamics, construction business leaders are not immune from the challenging business environment also faced (to varying degrees) by other sectors. Our 2024 report shows just 37% of construction business leaders and owners feel positive about economic factors (in the past two weeks) – the lowest ranked of the 17 business performance metrics we survey. Perhaps linked to this are external political factors, which also feature in the five lowest-scoring attributes, suggesting construction business leaders are still waiting for the relaxation of regulations and red tape that the new coalition Government promised during 2023 election campaigning.

% Construction business leaders feeling positive about each attribute (in the past two weeks)

More positively, the sector seems to be recovering from the labour supply issues that dominated 2023. Our 2024 report shows that while most leaders are looking for staff in some capacity, the majority are confident about filling these vacancies in the coming 12 months. High net migration into New Zealand during the past year may factor into this more positive labour supply sentiment, along with a general cool-down in project activity.

In the two weeks before being surveyed, 60% of construction business owners and leaders felt positive about their overall business performance (all or most of the time). This increases slightly to 63% expecting to feel positive in six months, showing a cautiously more optimistic forward view. The upcoming New Zealand Government Budget (30 May 2024) may be behind this hopeful outlook, when construction business leaders will be hoping for more certainty and support for the sector to be announced.

Time will tell how this cooling sector will fare long-term, but it’s clear that leaders are seeking clarity and direction as they look to the future.

“The sector has come off incredible highs, so it’s no surprise to see a fallback in the construction industry. The impact of high interest rates, along with other economic factors, is being felt across the sector and this will likely continue to impact the market for a while. In saying that, there are still opportunities for nimble and forward-thinking businesses. For the first time in our survey, we’ve seen respondents pointing to AI as being a risk to their business. Now is the time to get ahead of this technology and use it to your advantage, or risk being left behind.

Construction leaders are eager for more direction and action, particularly when it comes to Government decision-making. A clear pipeline of work and strategy of project commitments would be a massive boost to the sector, and leaders will be looking for this in the upcoming Budget and ongoing policy announcements.”

Nick Innes-Jones, BDO Construction Sector Leader

Nick Innes-Jones

“While there are clear challenges across the construction sector, I believe the industry has been right-sized after coming off record high levels. The economic impact of high inflation and interest rates has had a direct effect on activity in the sector, but there is light at the end of the tunnel as interest rate levels moderate. The industry has a long tail, so we can expect things to remain tight for at least another 12-18 months as activity comes back through the system. Those businesses that can, should take the time to refocus on their strategies, ensure they have the right labour on board, and look at other business improvements they can take now to prepare for a future settling of workload.”

Martin Veitch, BDO Head of Advisory

Martin Veitch

“New Zealand is finding its new normal after a continuous period of increased interest rates and high inflation. Alongside this, we’ve seen the new Government reduce its spending, which could result in fewer Government-funded projects moving forward - all of which impacts the construction sector. It will be interesting to see what will come out of the building consent reform. The aim of the reform is to reduce building material costs and alleviate supply chain disruptions. Worldwide there is an increased focus on reducing energy use and building emissions, with the EU targeting zero emissions for all new buildings by 2030. More of these influences and practices will come to New Zealand in future years. Staying on top of these changes and embracing the use of new products will be key for future success in the sector.”

.jpg?lang=en-NZ&ext=.jpg)

Bjorn de Nijs

The BDO Construction Sector Report, now in its sixth year, aims to shed light on the priority issues facing New Zealand’s construction businesses, now and into the future.

More information and support

|

Final comments from our Construction Sector Leaders