New Zealand’s economic challenges are being felt strongly by leaders across the country, with business’ cash flow and financial performance struggling to keep pace with wider market conditions.

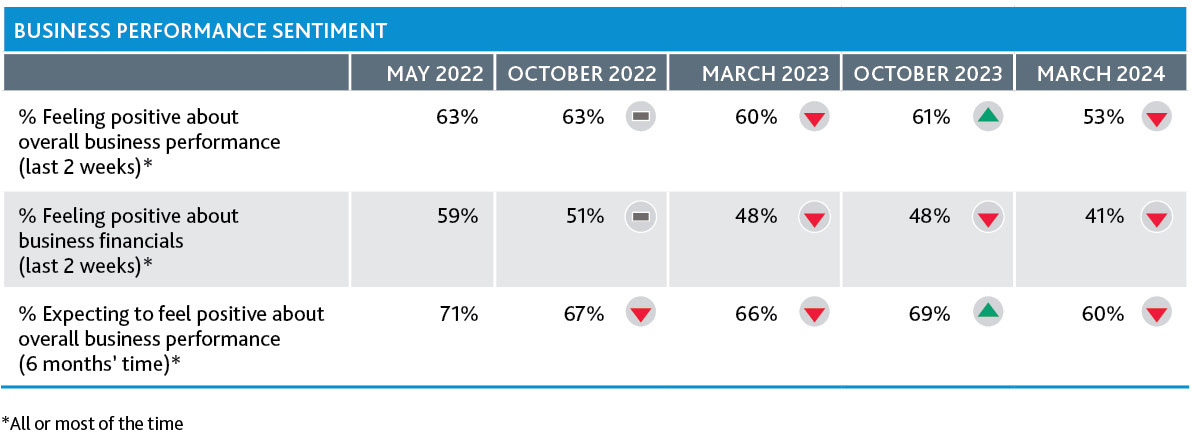

Overall business performance sentiment is at its lowest ever level since our first survey in May 2022, with just 53% of business leaders saying they have felt positive about their business performance all or most of the time in the past two weeks. This downward trend is echoed when looking at business financial sentiment, where just 41% of leaders felt positive about their business financials in the two weeks prior to the survey. And while business leaders are expecting to see improved business performance in six months’ time compared to now, with 60% expecting to feel positive about overall business performance, this future sentiment is lower than what we’ve seen in previous survey waves.

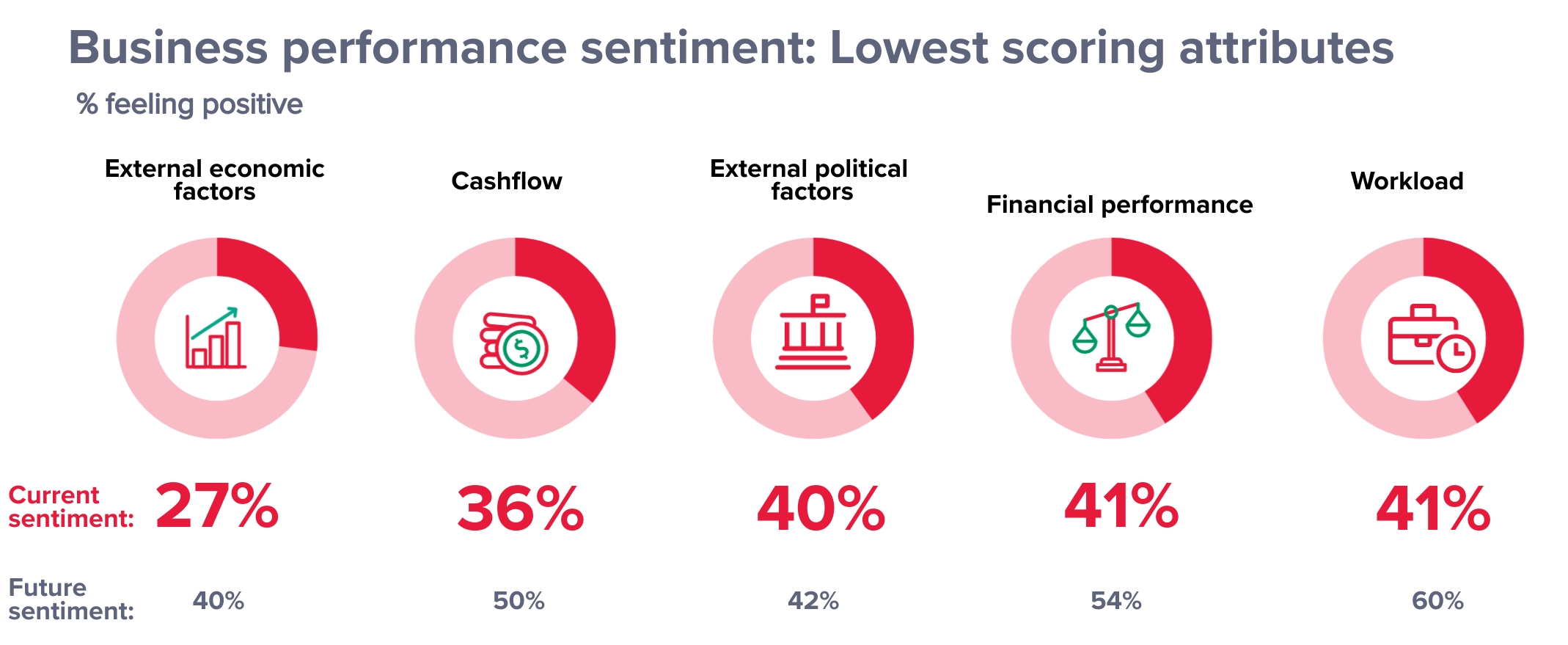

These business performance measures have contracted considerably since our October 2023 survey. Now, the reality of New Zealand’s tough operating environment continues to impact firms, who expect to see many of their business performance challenges remain in the coming six months.