Economy and forward work are key areas of concern for construction business leaders – but opportunities remain

More than two thirds (67%) of construction leaders expect inflation to significantly impact their profitability over the coming 12 months, and 49% point to high interest rates as having an expected impact on their bottom line. Their concern regarding economic conditions mirrors the broader business sector: The April 2024 BDO Business Wellbeing Index shows that not only are external economic factors the business performance attribute which leaders feel the least positive about, but they’re also the second-highest driver of negative wellbeing in leaders’ business lives.

While the annual rate of inflation is the lowest it’s been since 2021, at 4% it is still higher than the Reserve Bank’s target range of 1-3% and is contributing to cost of living pressures across the country. High interest rates are also at play, reducing consumer demand and impacting the financial feasibility of projects. The Reserve Bank of New Zealand has warned that inflation pressures could lead to global interest rates staying higher for longer.

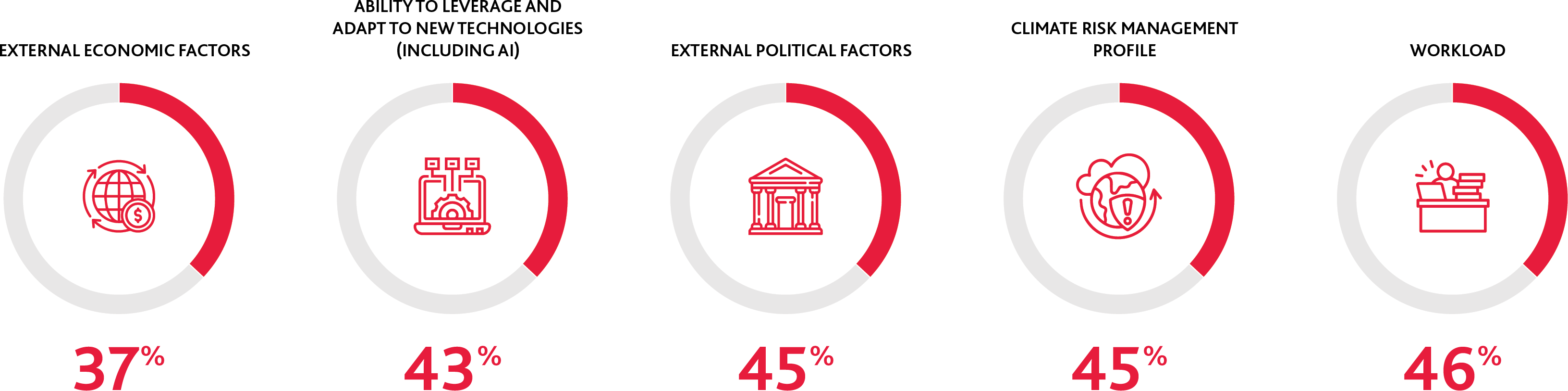

Another low-scoring attribute in our survey, which is likely linked to external economic factors, is external political factors. Just 45% of leaders have felt positive about external political factors in the past two weeks, and just 47% expect to feel positive about this measure in six months’ time. This is despite the formation of a new coalition Government which campaigned on being pro-business and promised to stimulate the economy. Now, survey respondents speak of slow decision-making, a lack of clarity and funding cuts creating issues for them, suggesting the new Government may need more time to make a positive impression on construction sector business leaders.

“Major projects are continually delayed or stopped once underway. This is normally due to different political priorities and is now due to a complete lack of funding for nearly all projects.” – Survey respondent (anon).

CONSTRUCTION LEADERS LEAST POSITIVE ABOUT ECONOMIC FACTORS AND AI

% business leaders feeling positive about each attribute

Increased competition is a key concern for construction business leaders, with many surveyed saying they expect competition to have a significant impact on their profitability over the next twelve months. As interest rates and high costs continue to slow the construction sector and lead to less work, leaders are expecting to see a more competitive tendering market. In turn, this could lead to a reduction in profit margins - something which the construction sector already appears to be struggling with.

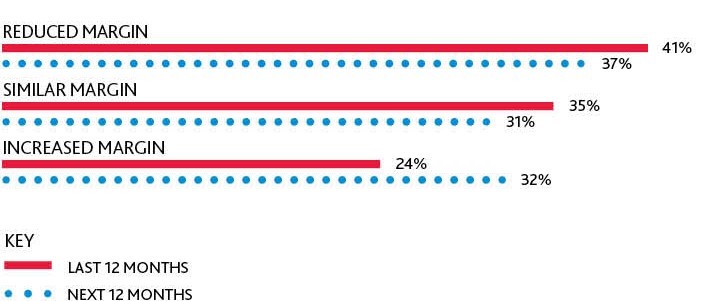

Just under a quarter of construction leaders reported an increased gross profit margin in the last 12 months, and a worrying 41% experienced a margin reduction. More tendering in a highly competitive industry may result in these margins falling further - a concern for business leaders who will need to understand how this may impact their cash flow. However, the sector is feeling more confident when looking to the future, with 32% expecting margins to increase in the next 12 months.

“[I expect] less work due to high costs/interest, therefore higher competition and likely lower margins” – Survey respondent (anon).

GROSS PROFIT MARGINS REDUCE FOR MANY

Change in gross profit margins last 12 months vs expectation for next 12 months

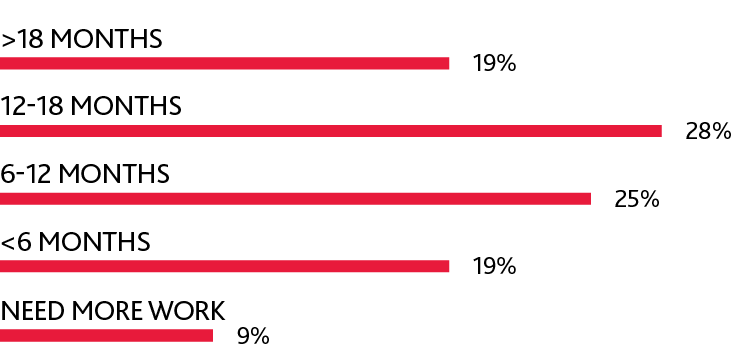

A major theme coming through from our survey is uncertainty around workloads and pipelines. While it’s positive to see that nearly half of the survey respondents have sufficient confirmed work beyond the next 12 months, more than a quarter don’t have enough work to stretch beyond six months, which can create cashflow concerns and staffing stress for businesses.

Workload and pipeline were often commented on by construction business leaders when discussing their greatest challenges or concerns over the coming 12 months. Cuts to Government funding and projects are a significant contributor to this, along with a slowdown in consumer spending as owners become more reluctant to spend in the current economic environment. Our survey shows construction business owners and leaders are increasingly concerned about securing sufficient work, with some suggesting they may need to downsize to stay afloat.

“[A big issue is] delays in workload due to client circumstances and government funding positions causing fluctuating workflows. This may lead to periods of both under and overutilisation of internal resources.” – Survey respondent (anon)

LESS THAN HALF OF BUSINESSES HAVE SUFFICIENT CONFIRMED WORK BEYOND 12 MONTHS

% Business leaders with sufficient confirmed work for each period

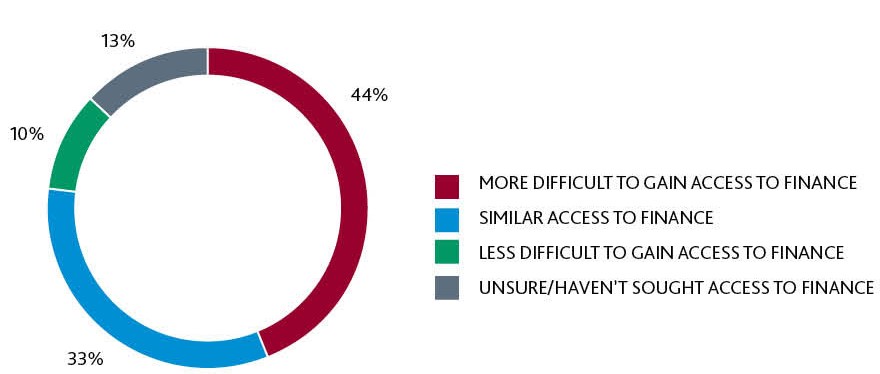

MANY LEADERS EXPERIENCE DIFFICULTY GAINING ACCESS TO FINANCE

Compounding this issue is the struggle many construction businesses are having with securing finance. Many leaders commented that they expect cash flow, financial issues and funding to be their main challenge in the coming year. In the past 12 months, significantly more respondents (44%) found it became more difficult to access finance for construction projects than those who found it became less difficult (10%). Projects are becoming less viable due to increased costs, which, along with rising interest rates, are creating real difficulties when it comes to accessing finance.

However, there may be hope ahead, with the Government recently announcing changes to the Building Act in a bid to increase the availability of building products and lower the cost of building in New Zealand. This will likely be welcomed by construction business leaders, many of whom would benefit from more options and access to overseas certified product to avoid issues like the Gib shortage in 2022. Leaders will will be looking for more announcements in the upcoming Budget - and an eventual easing in the tough economic conditions they’re operating in.

“We will need more work and easier funding from banks to survive. Compliance in the industry has got to a point where it is nearly impossible to do a full day’s productive work.” – Survey respondent (anon).

A chief concern identified by construction business leaders is also an opportunity. Just 43% said they were feeling positive about their ability to leverage and adapt to new technologies (including AI) – the second-lowest ranking attribute behind economic factors. Construction business leaders are also feeling less positive about their climate risk management profile than most other business performance attributes, although they expect this to improve in the coming six months.

FIVE LOWEST-SCORING BUSINESS PERFORMANCE METRICS

% Business leaders feeling positive all or most of the time, last 2 weeks

Both AI and climate change are undoubtedly a threat across industries, and construction is no different. However, with the current slowdown across the sector, now could be an ideal opportunity to take the time to educate and upskill in these areas to prepare for the future. This is particularly true of AI, which can be particularly helpful during the project management and preconstruction phases of projects. Leaders and owners who utilise a quieter work period to get to grips with this technology and look at ways to future-proof their operations against ongoing climate risks – may fare better in future.

Staffing continues to be a talking point for the construction sector, and while there are undoubtedly still challenges for some businesses in sourcing skilled labour, there are positive signs that we have moved away from the labour crisis seen in previous years.

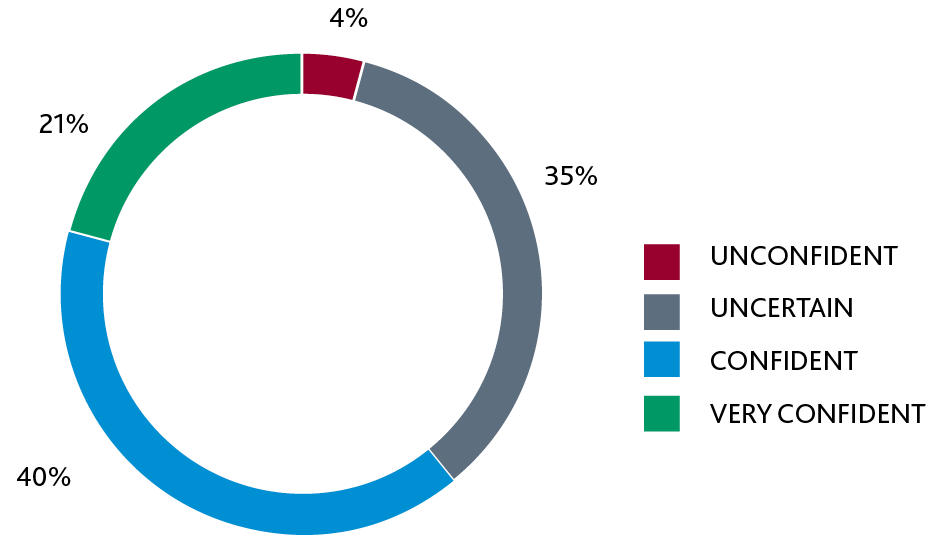

While most leaders will be looking for staff in the coming 12 months, the majority (61%) say they are confident about filling these vacancies. Just 4% are unconfident about their ability to fill vacancies and only 5% are over-staffed, suggesting there is some stability in the labour market. This contrasts with our 2023 report when 79% of construction leaders said that access to labour was having the biggest adverse impact on their business. Now, more than half of leaders felt positive about labour supply in the two weeks before being surveyed, and while many still have staffing-related concerns, this issue is now less prevalent than financial and forward work challenges.

LEADERS LARGELY CONFIDENT ABOUT FILLING STAFFING GAPS  Business leaders' confidence in filling vacancies (next 12 months)

Business leaders' confidence in filling vacancies (next 12 months)

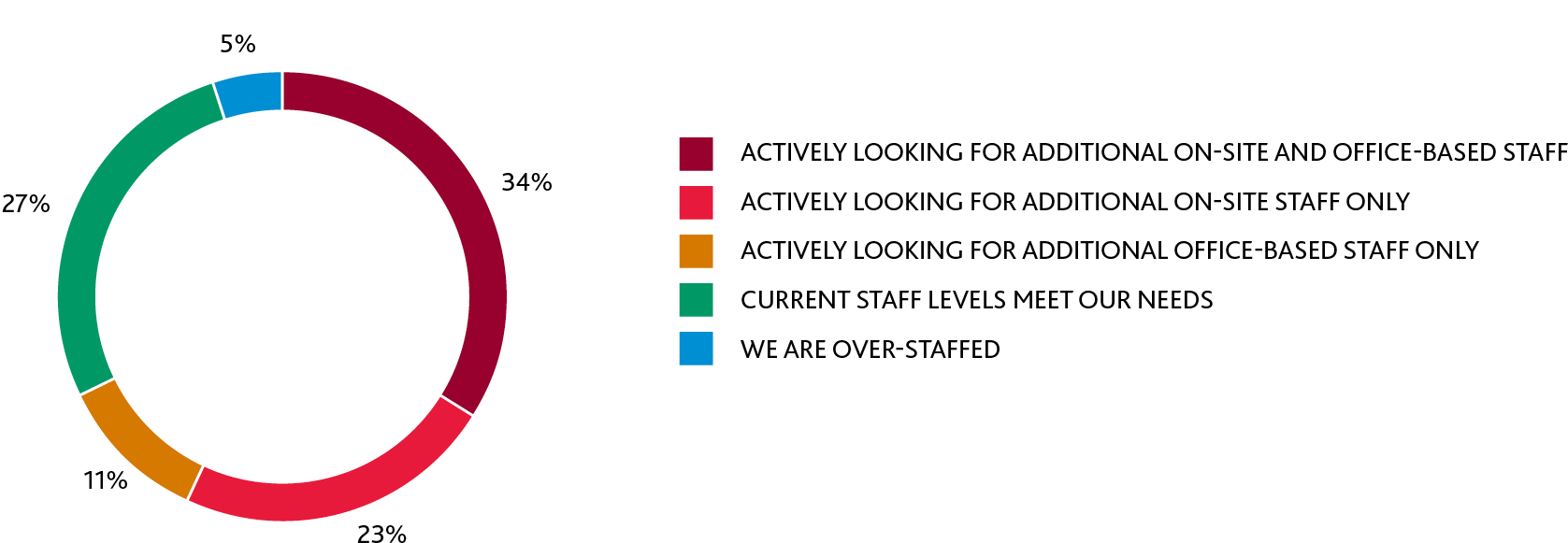

MOST BUSINESSES LOOKING FOR STAFF IN SOME CAPACITY

Business leaders' recruitment intentions (next 12 months)

Business leaders' recruitment intentions (next 12 months)

Overall, the construction sector has experienced a slowdown from where we’ve been in recent years, with companies no longer experiencing unsustainable workloads and huge bottlenecks around projects and staffing. The post-COVID construction boom has settled, and the quieter conditions now give construction leaders the space to focus on their businesses, revisit their strategies and plan for the coming years. However, concerns around economic conditions and political steer, coupled with forward workflow and funding issues, are unlikely to go away in a hurry, and leaders must stay alert to navigate through these.

For help in navigating the big issues, click here to view our business tips.