BDO's Financial Reporting Advisory team can provide assistance to navigate through NZ IFRS 16 complexities. We are dedicated to helping entities adopt NZ IFRS 16 in an efficient, thorough, and cost-effective way.

The initial adoption and application of NZ IFRS 16 needs to be considered in situations where:

- An entity is stepping up to adopt NZ IFRS for the first time (where the transition requirements of NZ IFRS 1 First-time adoption of NZ IFRS apply, including various transition exemptions and options).

- Or where an entity has acquired a business (acquiree) where lease contracts have been assumed (where the requirements of NZ IFRS 3 Business Combinations apply, requiring “re-set” accounting to be applied (even if the acquiree has previously been applying NZ IFRS 16)).

What needs to be done to adopt lease accounting?

The effort and expertise required will vary entity-to-entity, depending on:

- The size and age of an entity’s lease population.

- The nature of the items leased.

- The nature of an entity’s Group Structure.

- Which general accounting options an entity plans to elect.

- Which adoption options an entity plans to use.

As a result, a successful (and more importantly, compliant) adoption of NZ IFRS 16 is less likely:

- Key lease-related information is unknown, and

- An entity is unaware of the relevant application areas and “fishhooks” within NZ IFRS 16.

Approaches to tackle adoption

General advice and support

- Understanding and interpreting lease accounting.

- Understanding the adoption methods allowed.

- Understanding general scope-out options allowed.

- How to group lease into similar portfolios, so that single discount rates can be applied.

- Application to group structures, and inter-company leases.

- Reviewing lease agreements, and extracting key lease information required.

End-to-end project management

BDO Financial Reporting Advisory formally project manages the adoption of lease accounting on behalf of management, including:

- Project plan development.

- Assigning roles and responsibilities.

- Establishing project steering committee (if required).

- Overseeing roles and responsibilities assigned to BDO.

- Ensuring appropriate outputs and documentation is produced for management and external auditors.

Approaches to process the required accounting

Lease software solutions

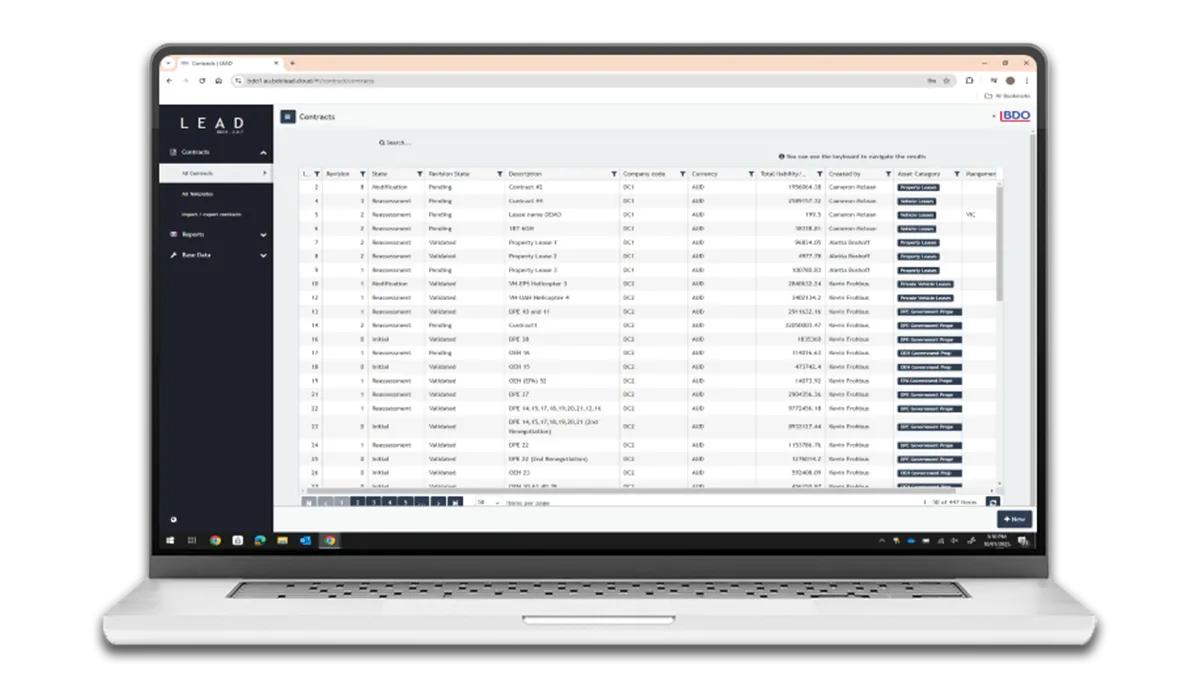

For entities with large, and/or more complex lease populations that require a more efficient and automated approach than a spreadsheet-based approach, BDO steps in with its BDO LEAD lease accounting service offerings:

Click the above links for more details on how we can assist.

Discount rate determination

In some cases, entities may need to engage valuation experts to model, determine, and provide (auditable) support to the discount rates used by the entity in applying NZ IFRS 16 accounting.

Where this is required, BDO’s Deal Advisory experts step in to provide these services for entities.

Lease publications and training content

BDO has a wide array of publications and other training material free available. Below is a one-stop-shop of this material for entities to access:

BDO NZ IFRS 16 Summary on a Page - High level overview of NZ IFRS 16 requirements conveniently reduced onto 3 pages.

BDO In Practice – IFRS 16 Leases - BDO's comprehensive publication on the technical requirements of IFRS 16, including various illustrative examples and commentary on issues currently being encountered in practice.

BDO eLearning - BDO’s free online training modules.

Thought leadership and blog articles of topical areas of lease accounting application in practice - see tiles below.