Martin Veitch

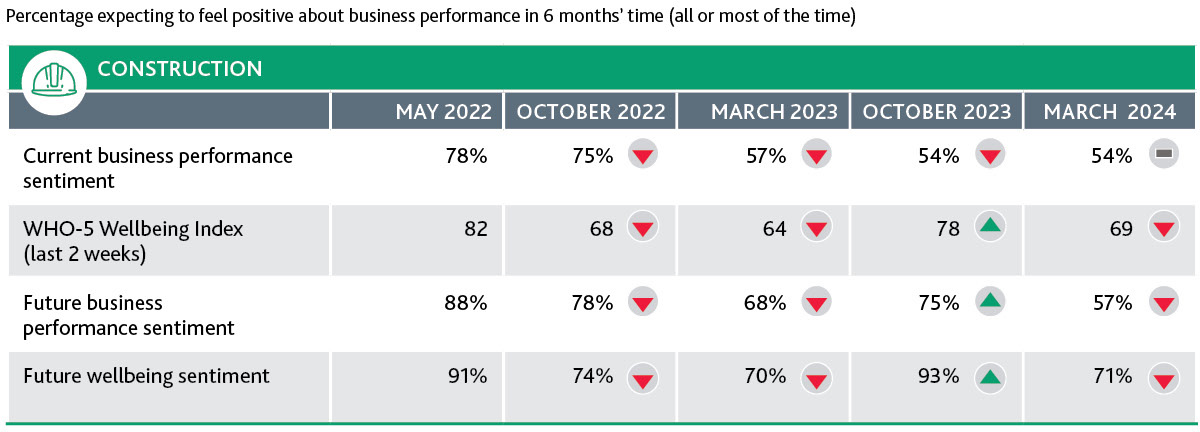

The economic impacts seen in different sectors across New Zealand are making their mark in construction too, driving negative wellbeing and creating business performance concerns for leaders in this space. Our March 2024 survey shows that while business leaders are currently feeling as positive about their business performance as they did in October 2023, their future view is less rosy than it was in our last survey wave.

View journalist Paddy Gower's conversation with Martin Veitch, BDO Head of Advisory, plus insights from Michael Diver, Director of Peter Diver Plumbing & Drainage Limited.

While sentiment in the construction sector is down from the highs we saw in the weeks immediately following the election, most measures have returned to levels similar to those in surveys prior. This suggests the October 2023 measure captured a moment of positivity for construction leaders, who may have been feeling enthusiastic about the Government’s pro-business approach and promises to cut red tape around building in New Zealand. However, change takes time, and construction leaders' static current business performance sentiment - and lower future business performance sentiment - shows leaders may still be waiting for conditions to improve.

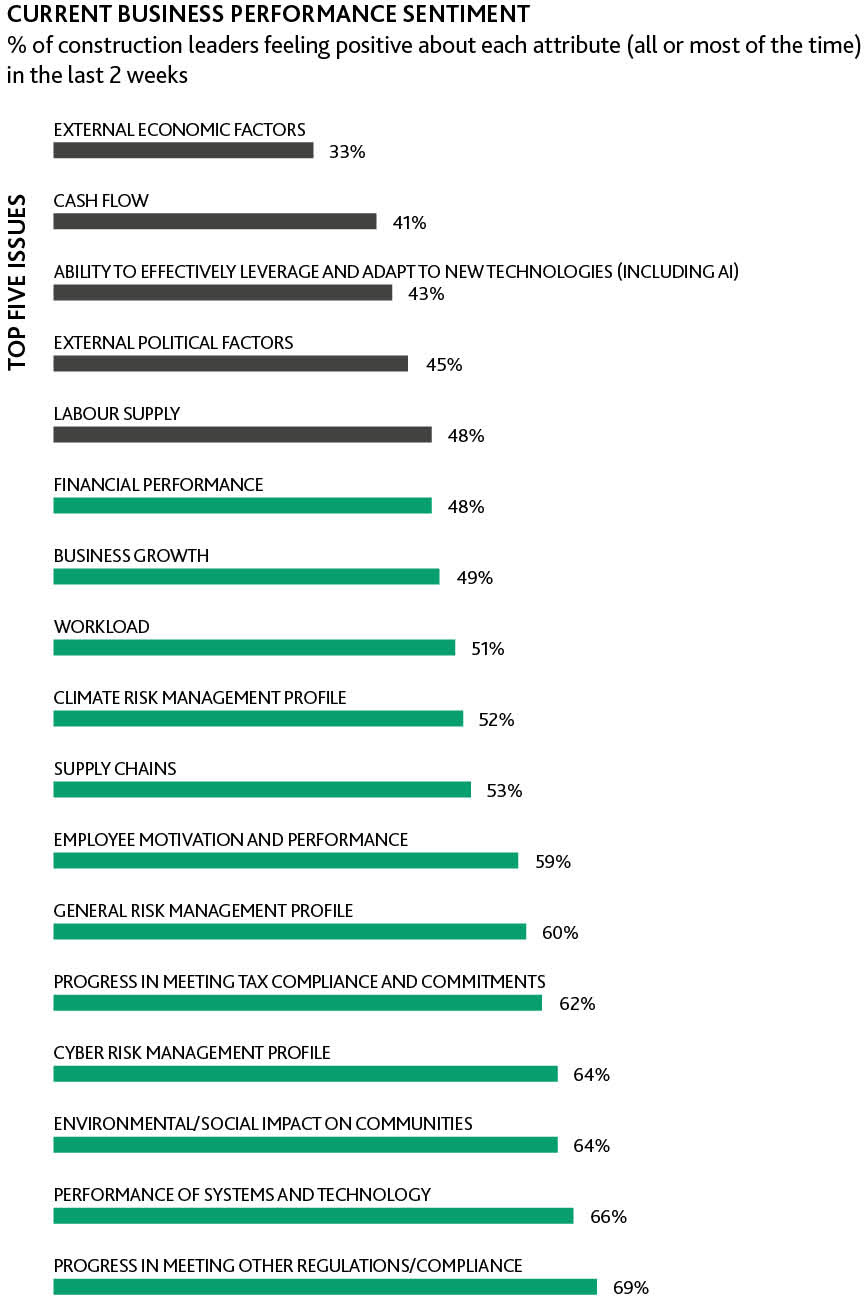

54% of construction leaders have felt positive about business performance all or most of the time in the past two weeks, which, while unchanged from October 2023, is down from what we saw in the post-COVID building boom of 2022. The residential sector may be feeling particularly hard hit, as home consents were down by 25% in 2023 compared to 2022. On a more positive note, our survey shows supply chains and labour supply are no longer a major concern for the sector, while leaders are feeling positive about meeting regulations and compliance and the performance of their systems and technology.

Looking ahead, just 57% of construction leaders expect to feel positive about business performance in six months’ time, down from 75% in October 2023. This result is the lowest we’ve seen since our first survey in May 2022 and reflects leaders’ concerns around economic factors and cashflow, which our survey shows are the measures construction leaders feel least positive about.

At 69 out of 100, construction leaders’ WHO-5 Index score - the World Health Organisation’s internationally recognised wellbeing measure – has decreased since October 2023, returning to levels seen prior to this post-election period. There is a similar trend when looking at future business performance sentiment. In our March 2024 survey, 71% of business leaders expect to feel satisfied with life all or most of the time in six months’ time, which has dropped from a record high of 93% in October and returned to similar levels to March 2023 and October 2022.

Our survey shows the main drivers of this negative wellbeing include business financial concerns, economic factors, and concerns around succession planning. As construction leaders continue to grapple with harsh economic conditions, it’s essential they have the right support to navigate any business performance and wellbeing challenges.

Martin Veitch

Nick Innes-Jones