For 2020 reporting dates, the long awaited new accounting standard on leases (NZ IFRS 16 Leases) comes into effect for for-profit entities who apply NZ IFRS.

As we have covered in previous Cheat Sheets, NZ IFRS 16 results in a fundamental change in the way that lessees will need to account for most of their lease agreements.

In our experience, one often overlooked area of the new requirements is how this change in accounting treatment in one area, may actually have a consequential impact to another area of accounting… the carrying value of manufactured inventories (and thereby, Cost of goods sold (CoGS), and Gross profit).

This is because NZ IFRS 16 decreases the expenses that are (can be) included in overheads to be allocated to the cost of manufactured inventories – thereby (i) decreasing CoGS, and (ii) increasing Gross Profit

Where an entity is working through the adoption of NZ IFRS 16 at the end of the year, this will mean that the inventory cost accounting that has been determined on pre-NZ IFRS 16 accounting treatments, will need to be “unpicked” to bring these in.

This Cheat Sheet has been produced as a high-level overview of the impact of NZ IFRS 16 on inventory cost accounting.

Need assistance with your adoption of NZ IFRS 16?

BDO IFRS Advisory is a dedicated service line available to assist entities in adopting NZ IFRS 16. Further details are provided on the following page for your information.

What is covered in the Cheat Sheet

In order to navigate through these areas of accounting, this Cheat Sheet is broken down into the following sections:

- Reminder of the changes in expenses as a result of NZ IFRS 16

- Costs that can be included in manufactured inventories

- Resulting impact

- What needs to be done?

1. Reminder of the changes in expenses as a result of NZ IFRS 16

NZ IFRS 16 changes the look and feel of an entity’s income statement – as well as bringing new asset and liability balances onto the balance sheet.

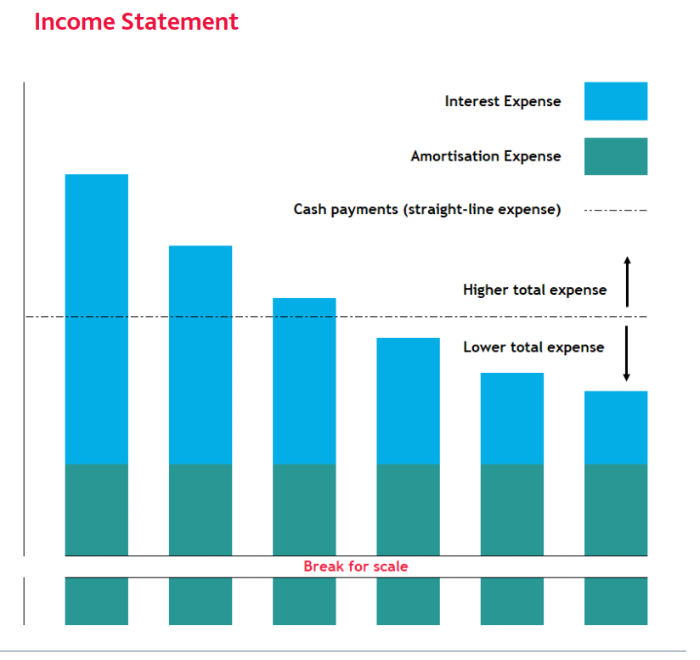

Rent expenses (reflected by the “dashed” line in the adjacent graph), are replaced with different (and unequal) amounts of:

- Interest expense (charged on the new Lease liability balance)

- Amortisation expense (unwinding of the new Right-of-use Asset balance).

Accordingly, subtotals, financial metrics, and other financial statement areas that incorporate these amounts will also change as a consequence of NZ IFRS 16.

Cue our discussion with respect to manufactured inventories

2. Costs that can be included in manufactured inventories

The cost of inventories includes three components:

|

Purchase costs Purchase price, unrecoverable taxes and duties, inbound transport and handling etc. |

Conversion costs Direct labour, allocation of fixed and variable production costs. |

Other costs Other direct costs to bring inventory to required condition or location. |

When it comes to manufactured inventories, the conversion costs above are a fundamental part of the “cost build”.

Conversion costs include an allocation of fixed costs that relate to the production of inventory. So where inventory is being produced in leased premises, and/or with leased equipment, conversion costs would have previously included (a portion of) the rental expense for these items.

This is still the case when NZ IFRS 16 is adopted… however the value of the amounts, and which amounts you can allocate to conversion costs, change.

3. Resulting impact

So from the above it is important to note that in terms of the new NZ IFRS 16 expenses (if the associated Right-of-use asset is being used in the production of inventory):

- Amortisation expense can be included in conversion costs (where Rent expense was previously)

- Interest expense CANNOT be included in conversion costs.

This is because for accounting purposes, interest expense is considered a financing cost, rather than an operating cost[1].

|

|

|

|

|

[1] Note, that if the inventory is a “qualifying asset” under NZ IAS 23 (i.e. one that takes a substantial period of time to prepare – being usually those with a “maturing” process involved – e.g. certain cheese, wine, spirts etc.) then a portion of interest costs is required to be capitalised to the cost of inventory.

4. What needs to be done?

If your entity is going through the adoption of the NZ IFRS 16 as part of the 2020 year end process (i.e. after the fact), then you will need to ensure that your overhead cost allocation to cost of inventory and cost of goods sold is based on NZ IFRS 16 numbers.

If you have yet to perform the overhead cost allocation, then the process is simple, wait until the NZ IFRS 16 numbers are finalised, and perform the allocation.

If you have already performed the overhead cost allocation on non-NZ IFRS 16 numbers (including any year-end wash-up), then you will need to reverse out the previous allocation, and re-performed the allocation once the NZ IFRS 16 numbers have been finalised.

BDO IFRS Advisory

Members of BDO’s IFRS Advisory department come ready with real life experience in applying IFRS and are therefore well placed to provide entities with the expertise and assistance they require.

For more information as to how BDO IFRS Advisory might assist with assessing the impact of your adoption to new accounting standards please contact James Lindsay at BDO IFRS Advisory and visit our IFRS Advisory webpage for more information and resources on NZ IFRS 16.

This publication has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. The publication cannot be relied upon to cover specific situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact your respective BDO member firm to discuss these matters in the context of your particular circumstances.