Identifying embedded leases

Identifying embedded leases

IFRS 16 Leases requires an entity to recognise a right-of-use (ROU) asset and a lease liability in the balance sheet for all leases. A lease is a contract, or part of a contract, that conveys the right to use an asset (the underlying asset) for a period of time in exchange for consideration.

| Identifying leases may be easy if the agreement is called a ‘lease’. However, many service contracts, particularly for outsourced services, are not called ‘leases’ and may contain an embedded lease that must be extracted and accounted for separately under IFRS 16. In practice, embedded leases may be hard to spot and get missed because they are negotiated and administered by operational staff in an organisation rather than the finance team. |

What is an embedded lease?

An embedded lease is not defined in IFRS 16 but refers to a lease agreement embedded within a larger contract. An entity that has entered into a service contract to outsource tasks previously conducted in-house may find that it has embedded leases. Unless these are short-term or for items of low value, they must be accounted for as leases under IFRS 16. Other service contracts may also contain embedded leases.

| Entities should review all material service contracts to ensure they have identified and accounted for embedded leases. |

Accounting for embedded leases

IFRS 16, paragraph 12, requires each lease component within a contract to be accounted for separately from non-lease components. There is a practical expedient whereby a lessee can elect not to separate non-lease components from lease components, resulting in the non-lease components being combined with the lease and accounted for as one. However, the opposite does not apply. Entities cannot combine lease components with non-lease components and thereby avoid lease accounting. So, entities must identify all embedded leases for separate accounting.

How to identify embedded leases?

| When reviewing each service contract, the finance team should prioritise the review of contracts for outsourced services, and then work down the chain to identify potential embedded leases in other service arrangements. A simple service arrangement may give an entity the right to control the use of an identified asset for a period of time in exchange for consideration. |

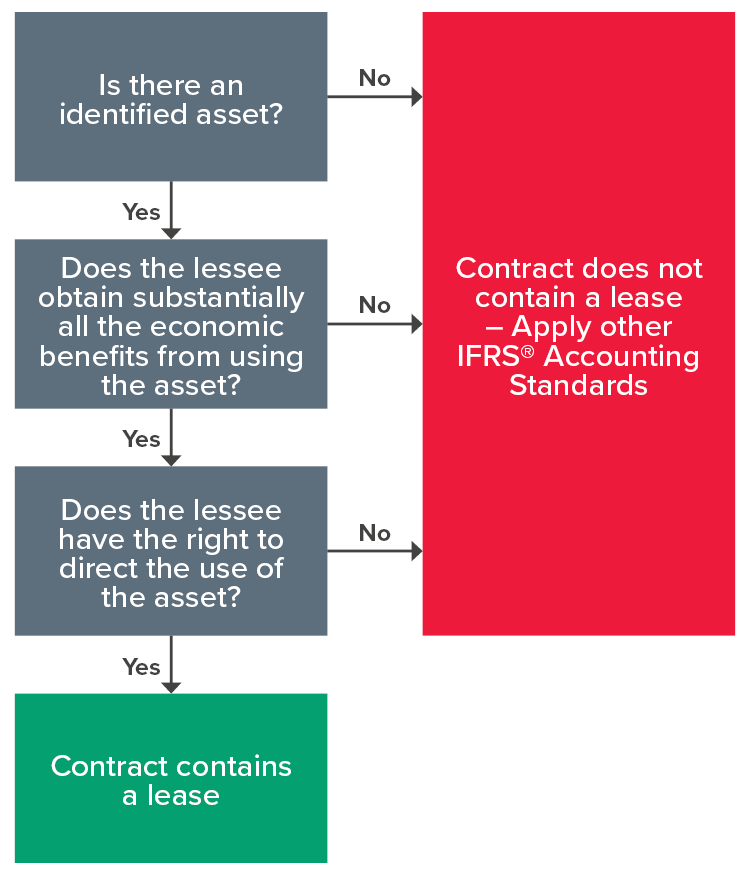

In determining whether an entity has the right to control the use of an identified asset for a period of time, an entity must, throughout the period of use, have both of the following:

- The right to obtain substantially all of the economic benefits from the use of the identified asset, and

- The right to direct the use of the identified asset.

This is illustrated in the diagram below.

The following articles will help you understand more about the three steps shown above:

- Is there an identified asset?

- Does the lessee obtain substantially all the economic benefits from using the asset?

- Does the lessee have the right to direct the use of the asset?

Judgement may be required for each of the three decisions shown in the diagram above, and the linked articles provide more information to help you along the way.

Examples of embedded leases

As noted above, we typically see embedded leases in service contracts - particularly in outsourced service contracts. Examples include:

- Rental agreements for printers/photocopiers charged based on the number of print pages (these may include the provision for goods such as ink toner)

- Provision of transport services in dedicated branded trucks (these may also include the provision of driver services)

- Logistics contracts may involve dedicated storage areas for the customer, as well as the provision of removalist services

- Dedicated fibre optic cable transmission lines

- Cloud-based storage solutions via dedicated servers

- Contracts for the purchase of substantially all the energy a facility produces in a remote location.

Allocating consideration to lease and non-lease components

If a contract contains an embedded lease, the consideration must be allocated across the lease and the non-lease components based on their stand-alone prices.

More information

Please refer to our publication on IFRS 16 Leases for additional guidance.

Need help?

Lease accounting can be judgemental and complex. BDO has an IFRS 16 cloud-based technology solution called ‘BDO Lead’ that gives you control over your lease data, and the ability to process changes and prepare reports effectively and efficiently across all your leases. Alternatively, if you only have a few leases, we also provide outsourced lease management services where we handle all necessary calculations and our expert team prepares your journals and reports.

Please contact our IFRS® Advisory team for help.

For more on the above, please contact your local BDO representative.

This article has been based on an article that originally appeared on BDO Australia, read the original article here.