Although the covenant in Example D(III)-2 was not met as at 30 September 20X1, it was waived by the bank prior to the reporting date, 31 December 20X1. Entity A, therefore, has a right to roll over the loan for at least twelve months after the reporting period under an existing loan facility, and the loan is therefore classified as a non-current liability on 31 December 20X1. This is despite the next loan covenant being tested in nine months’ time on 30 September 20X2. BDO’s view is that IAS 1, paragraph 72B(b) applies to this future covenant test, and it does not affect Entity A’s right to defer settlement for at least twelve months as at 31 December 20X1.

Negotiations for a waiver of a breach are ongoing at the end of the reporting period (Example D(IV))

Entity A has a long-term loan that is due for repayment on 31 December 20X1, which is the end of the reporting period.

The loan arrangement provides Entity A with a right to roll over the loan for a period of five years if a working capital covenant is met as at 31 December 20X1.

Entity A does not meet the covenant as at 31 December 20X1.

At the end of the reporting period, Entity A and the lender are negotiating whether to extend the loan for a period of two years, however, discussions are ongoing.

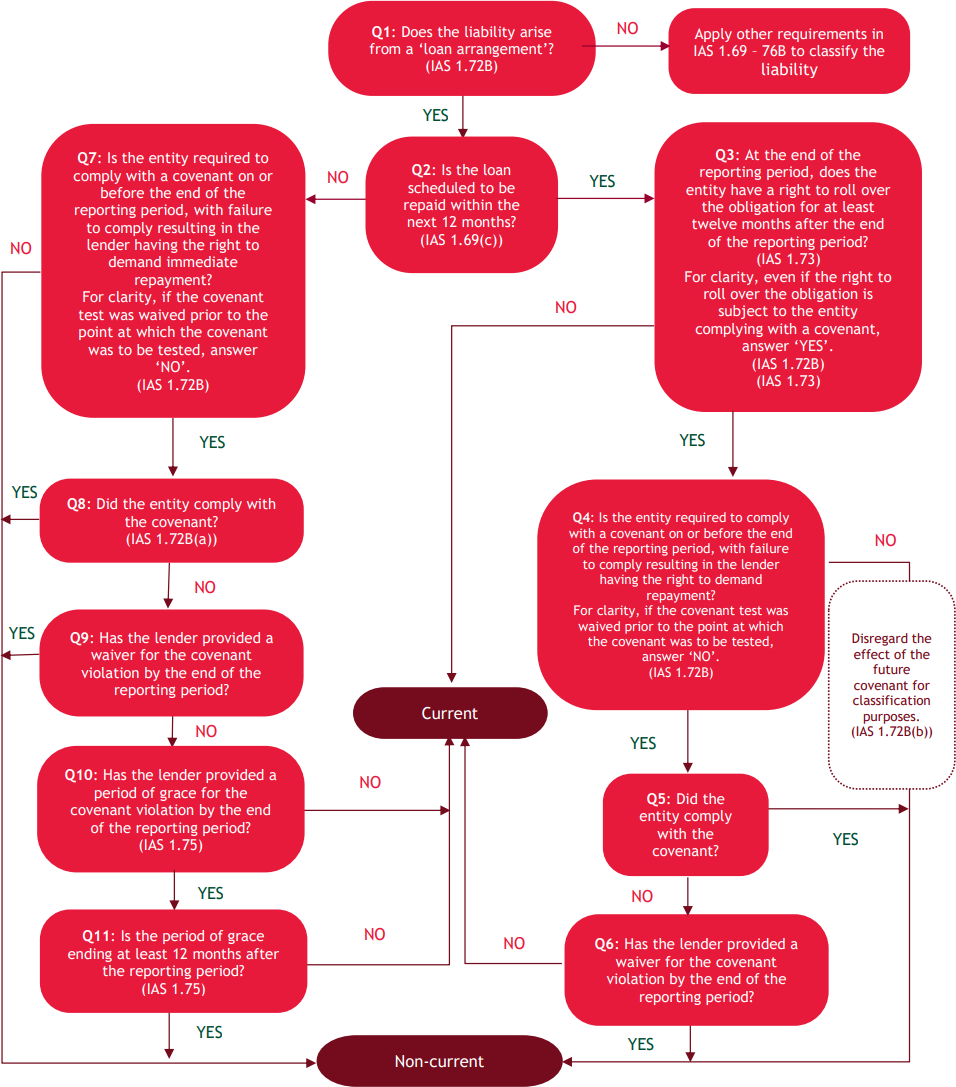

Entity A is required to comply with a covenant at the end of the reporting period, 31 December 20X1. Therefore, the answer to Question 4 is ‘Yes’.

Entity A did not comply with the covenant, so the answer to Question 5 is ‘No.

The lender did not provide a waiver for the covenant violation by the end of the reporting period. Therefore, the answer to Question 6 is ‘No’.

The loan is classified as a current liability as at 31 December 20X1.

The fact that Entity A and the lender are negotiating an extension of the loan as at 31 December 20X1 does not affect the above analysis. If the lender agrees to extend the loan term after the end of the reporting period, but before the financial statements are signed, this is considered a non-adjusting post-balance date event because Entity A did not have the right to defer settlement for at least twelve months at the end of the reporting period.

Disclosure about standards issued not yet effective

We remind entities preparing Tier 1 general purpose financial statements of the requirement to disclose and quantify the impact of amending standards that will take effect in a later period. Entities with loan arrangements subject to loan covenants will have to assess the implications of these IAS 1 changes on their borrowings and disclose the effect on the comparative and opening balance sheets for reporting periods starting before 1 January 2024.

More information

For more information on this topic, please look at our new publication.

Need help?

Classifying loan arrangements and other liabilities as current or non-current may be complex, particularly when they involve roll overs and covenant tests. Please contact our Financial Reporting Advisory team for help.

For more on the above, please contact your local BDO representative.

This article has been based on an article that originally appeared on BDO Australia, read the original article here.