These changes apply to Tier 1 and Tier 2 for-profit entities to annual periods beginning on or after 1 January 2024. Classification of your liabilities may be impacted by one or more of the changes to NZ IAS 1 Presentation of Financial Statements, namely:

a. The right to defer settlement need not be unconditional and must exist at the end of the reporting period

b. Classification is based on rights to defer, not intention

c. Early conversion options for convertible notes that can be settled before maturity by issuing the entity’s own equity instruments will result in the underlying liability being classified as CURRENT if the conversion feature is classified as a liability/derivative liability rather than as equity.

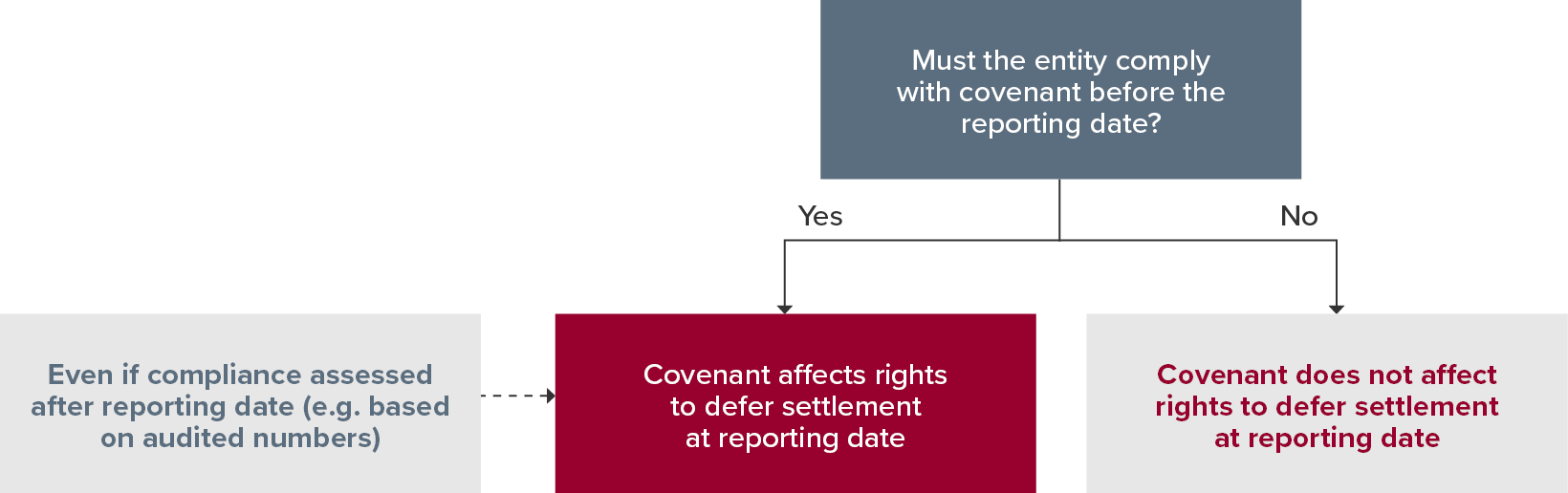

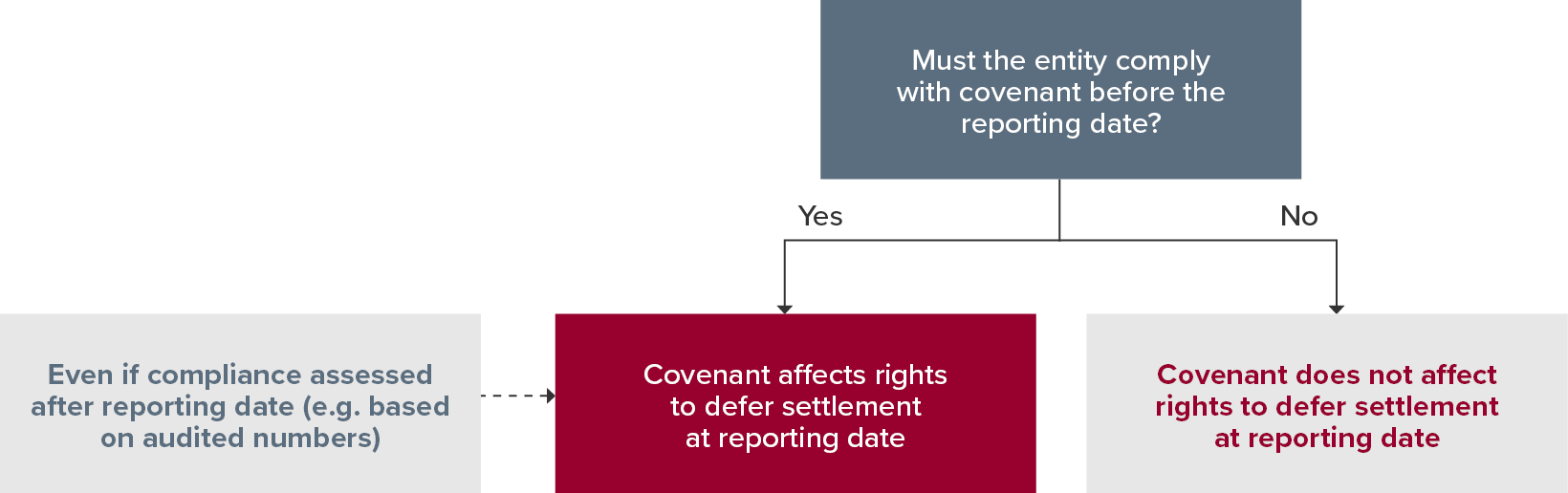

Regarding a., if your entity has loan arrangements subject to covenants, the amendments clarify when the covenants affect classification at the reporting date. This is illustrated in the diagram below.

Assessing whether the entity must comply with a loan covenant before the reporting date may depend upon whether bankers have provided a ‘waiver’ or a ‘period of grace’. Our publication uses a flowchart and examples to help you determine the correct classification of your loan arrangements.

For Public Benefit Entities, please note the External Reporting Board (XRB) has incorporated similar requirements for liability classification as current or non-current via the 2024 Omnibus Amendments to PBE Standards which is effective for annual periods beginning 1 January 2026.