Classifying borrowings with covenants: Key considerations

Classifying borrowings with covenants: Key considerations

For Tier 1 and tier 2 for-profit entities, new rules for classifying liabilities as current or non-current commenced for annual periods beginning on or after 1 January 2024.

| (Tier 1 and Tier 2 Public Benefit Entities should note that similar new rules are on the way for annual periods commencing 1 January 2026). |

One of the most complex areas of the new rules relates to entities classifying loan arrangements with loan covenants.

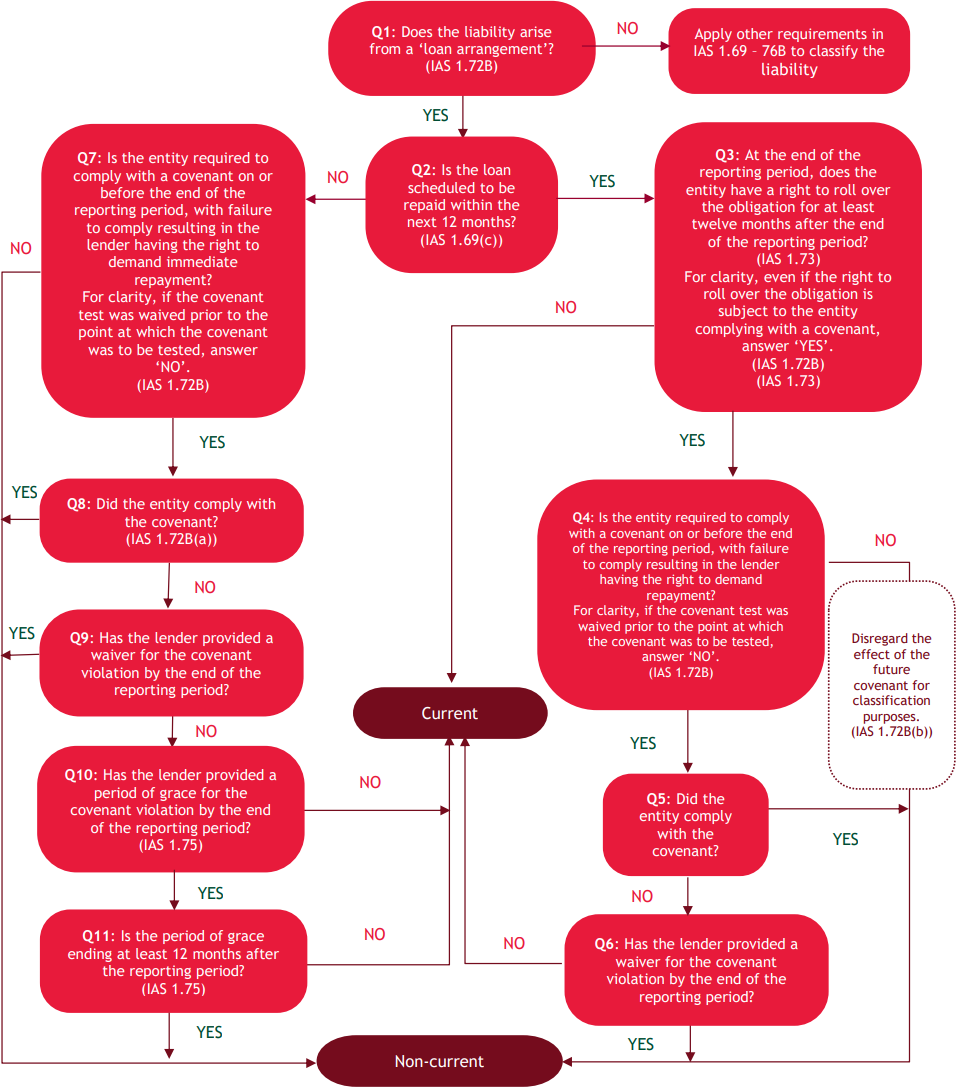

BDO’s publication, IFRS Accounting Standards in Practice - Classification of loans as current or non-current, includes a flow chart and numerous examples to help you determine the correct classification of your loan arrangements. Our previous articles showcased examples where compliance with loan covenants is required at the end of or after the reporting period, before the end of the reporting period, quarterly, in order to roll over an obligation for an existing loan arrangement and other common practice issues.

| This month we look at new examples of common practice issues - loan arrangements with covenants related to the sale of a subsidiary, revenue, and the construction of a factory building. |

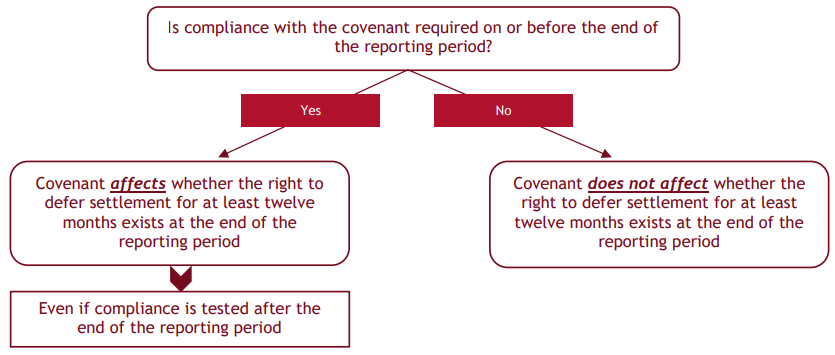

The following diagram summarises whether loan covenants will affect the classification of your loan arrangements (NZ IAS 1 Presentation of Financial Statements, paragraph 72B):

To classify a loan as a non-current liability at the reporting date, it must meet any loan covenant test required on or before the end of the reporting period.

- A current liability because the borrower does not have a right to defer settlement, or

- A non-current liability if the entity obtains, before the end of the reporting period, a waiver for the breach, or a period of grace whereby the borrower agrees not to demand repayment for at least twelve months after the end of the reporting period. Please refer to our previous article, which explains the difference between a waiver and a period of grace in more detail.

Flow chart

Our publication includes a flow chart to help you determine the appropriate classification of a loan arrangement with loan covenants.

Example E(IV) – Covenant related to a subsidiary

Entity A has a bank loan that is scheduled to be repaid on 31 December 20X5.

Entity A must comply with a covenant that prohibits it from selling a subsidiary until the loan is fully repaid.

If Entity A fails to meet the covenant (i.e., it sells the subsidiary before repaying the loan), the lender has the right to demand immediate repayment of the loan.

On 15 November 20X3, Entity A sold the subsidiary and breached the covenant, resulting in the lender having the right to demand immediate repayment of the loan.

On 15 December 20X3, Entity A and its lender agreed that the lender would waive its right to demand immediate repayment of the loan because of the breach of covenant that occurred on 15 November 20X3. However, the proviso is that Entity A improves its financial results, such that it meets a specified working capital covenant as at 31 March 20X4. This working capital covenant was not part of the original terms of the loan.

If Entity A fails to meet the working capital ratio as at 31 March 20X4, the lender will have the right to immediately demand repayment of the loan.

Entity A’s year-end is 31 December 20X3.

Analysis

Using the flowchart above, Entity A classifies the loan as a non-current liability as at 31 December 20X3.

| Questions |

Answer |

|---|---|

|

Question 1: Does the liability arise from a loan arrangement? |

Yes |

|

Question 2: Is the loan scheduled for repayment within the next 12 months? |

No |

|

Question 7: Is the entity required to comply with a covenant on or before the end of the reporting period, with failure to comply resulting in the lender having the right to demand immediate repayment? Note: If the covenant tested was waived prior to the point at which the covenant was tested, answer ‘No’. |

No Although Entity A breached the loan covenant on 15 November 20X3 when it sold the subsidiary, the lender provided a waiver of its right to demand immediate repayment because of the breach before the end of the reporting period (15 December 20X3). The new covenant inserted on 15 December 20X3 will be tested after the end of the reporting period. Therefore, it does not affect whether the right to defer settlement exists at the end of the reporting period. |

|

Classification |

Non-current liability |

| If the new covenant is breached on the date of testing, 31 March 20X4, the lender regains the right to demand immediate repayment. This right arises from the breach of the new covenant and not the original breach of the covenant related to the sale of subsidiary. This is because the lender surrendered its rights to demand immediate repayment when the subsidiary was sold. |

Example E(V) – Covenant related to revenue

Entity B obtains a bullet bank loan on 1 January 20X1, repayable after 5 years.

The loan arrangement includes a covenant that requires Entity B to have revenue of $10 million in the year 20X1, increasing by 5% each year until the loan is repaid.

If Entity B fails to meet the covenant, the bank obtains the right to demand immediate repayment of the loan.

Entity B’s annual reporting period end is 31 December. Entity B is preparing its interim financial statements for the nine months ended 30 September 20X1.

Entity B’s revenue for the nine-month period is $6 million. Entity B’s management believes that it is highly unlikely that Entity B will meet the $10 million revenue covenant by 31 December 20X1.

Entity B has not received a waiver or a period of grace for the anticipated breach of covenant before the end of the interim reporting period.

Analysis

Using the flowchart above, Entity B classifies the loan as a non-current liability as at 30 September 20X1.

| Question |

Answer |

|---|---|

|

Question 1: Does the liability arise from a loan arrangement? |

Yes |

|

Question 2: Is the loan scheduled for repayment within the next 12 months? |

No |

|

Question 7: Is the entity required to comply with a covenant on or before the end of the reporting period, with failure to comply resulting in the lender having the right to demand immediate repayment? Note: If the covenant tested was waived prior to the point at which the covenant was tested, answer ‘No’. |

No The covenant is required to be complied with on 31 December 20X1, which is after the current interim reporting period ending 30 September 20X1. Therefore, the covenant does not affect whether the right to defer settlement exists as at 30 September 20X1. |

|

Classification |

Non-current liability |

As Entity B’s right to defer settlement is subject to the entity complying with covenants within twelve months after the reporting period, the disclosure requirements in NZ IAS 1.76ZA apply.

BDO commentThe covenant in the above example is a cumulative one, i.e. the revenue target to be met on 31 December 20X1 is to be achieved cumulatively throughout the year up to the point of testing on 31 December 20X1. A question arises as to whether this might affect the loan classification on 30 September 20X1.It should be noted that the covenant is to be tested on 31 December 20X1, and it is either met or breached on that day. This does not affect the existence of the right to defer settlement in reporting periods ending prior to the testing date. For other covenants, such as the requirement to meet certain ratios like a debt-equity ratio or a working capital ratio, the covenant is not cumulative, as it is tested at a point in time. However, the entity’s performance in the period leading up to the testing date nevertheless contributes to the entity achieving a certain ratio. Whether the covenant is cumulative (as in the revenue example) or point-in-time (as for a debt-equity or working capital ratio), the application of the requirements will be applied the same way. The effects of covenant breaches expected to occur after the reporting period are disregarded to determine the classification of liabilities at the end of the reporting period. |

Example E(VI) – Covenant related to construction of a factory building

Entity C obtains a bank loan on 1 January 20X2 to construct a new factory building.

The loan arrangement requires completion of construction of the factory building within two years, and production to commence within two and a half years, from the date the loan was advanced.

When the loan was obtained, the management of Entity C estimated that the construction of the factory building would take approximately 18 months to complete, and production would commence 22 months from the date on which the loan was advanced.

However, soon after the construction commenced, some environmental concerns were raised and the construction had to be stopped. By 31 December 20X2, Entity C was still unable to resume construction as it was in the process of addressing the environmental concerns.

In December 20X2, Entity C’s management expected construction to resume in four months and take another 18 months to complete. Therefore, as required by the loan arrangement, Entity C would not be able to complete the construction within two years from the date the loan was advanced.

Entity C’s year-end is 31 December 20X2.

No waiver or period of grace is received from the bank by 31 December 20X2 for the anticipated breach of covenant.

Analysis

Using the flowchart above, Entity C classifies the loan as a non-current liability as at 31 December 20X2.

| Question |

Answer |

|---|---|

|

Question 1: Does the liability arise from a loan arrangement? |

Yes |

|

Question 2: Is the loan scheduled for repayment within the next 12 months? |

No |

|

Question 7: Is the entity required to comply with a covenant on or before the end of the reporting period, with failure to comply resulting in the lender having the right to demand immediate repayment? Note: If the covenant tested was waived prior to the point at which the covenant was tested, answer ‘No’. |

No The covenant must be complied with after the end of the reporting period, i.e. the first stage of the covenant is tested two years after the loan was advanced and the second stage six months later. |

|

Classification |

Non-current liability |

In this case, the covenant is certain to be breached. Nevertheless, management’s expectations or the likelihood of breach of covenant after the end of the reporting period do not affect whether the right to defer settlement exists at the end of the reporting period. Any covenant that is required to be complied with after the end of the reporting period is disregarded for classifying the liability as current or non-current at the end of the reporting period.

BDO commentEntity C is required to provide adequate disclosures that would enable the users of financial statements to understand the possibility of a future covenant breach and its effect on the entity’s financial position.The disclosure requirements of NZ IAS 1.76ZA only apply where the entity is required to comply with covenants within twelve months after the reporting period. In this case, the entity is required to comply with covenants after twelve months from the end of the reporting period because the covenant test date is 1 January 20X4. Nevertheless, NZ IAS 1.112(c) requires an entity to disclose information that is not presented elsewhere in the financial statements, but which is relevant to the understanding of the financial statements. Therefore, if the information about the highly probable or certain breach of covenant in future is considered relevant for an understanding of the financial statements, Entity C must provide adequate disclosures, even though there may not be a specific disclosure requirement for this. |

Restating comparatives

These new rules for classifying liabilities as current or non-current commenced for annual periods beginning on or after 1 January 2024. Entities with 31 December 2024 and 30 June 2025 reporting dates must reassess whether their liabilities arising from loan arrangements with loan covenants are appropriately classified. Any changes in classification apply retrospectively, so comparatives will need to be restated as follows:

|

Year-end |

First-time application |

Comparative restatement |

Opening balance sheet restatement |

|---|---|---|---|

|

31 December |

31 December 2024 |

31 December 2023 |

1 January 2023 |

|

31 March |

31 March 2025 |

31 March 2024 |

1 April 2023 |

|

30 June |

30 June 2025 |

30 June 2024 |

1 July 2023 |

|

30 September |

30 September 2025 |

30 September 2024 |

1 October 2023 |

Need help?

Classifying loan arrangements and other liabilities as current or non-current may be complex, particularly when they involve roll overs and covenant tests. Please contact our Financial Reporting Advisory team for help.For more on the above, please contact your local BDO representative.

This article has been based on an article that originally appeared on BDO Australia, read the original article here.